Dealing with tipped employees makes for some added due diligence on the part each employer to process a payroll correctly. Here in Texas, you may take a tip credit on any employee receiving and claiming their tips in the service industry. Usually, servers and bartenders make $2.13 per hour after a $5.12 tip credit has been taken. Here are a few questions to ask yourself when paying a tipped employee:

1. Do you know what the correct overtime pay rate is for your tipped employees? The correct overtime pay rate for a tipped employee is $7.25 x (1.5) = $10.87* then subtract the tip credit $10.87 – $5.12 = $5.75*. So, $5.75* is the overtime pay rate for a tipped employee in Texas when the regular rate is $2.13.

2. What happens when the server or bartender does not earn enough money in tips to meet the state’s minimum wage requirement? In Texas, if your employee does not earn enough money in tips to meet the minimum wage requirement of $7.25, then the employer must make up the difference and this is called a “tip makeup.” For example if an employee works for 10 hours in one week at $2.13 per hour and has $50.00 in tips, they will get $2.13 x 10 = $21.13 then you add their tips to get $71.13. Minimum wage for 10 hours worked = $72.50, so now the employer must make up the difference of $72.50-$71.13 = $1.37. This happens far more often than employers realize but most outsourced payroll companies will offer a way to track this for you if you ask for it.

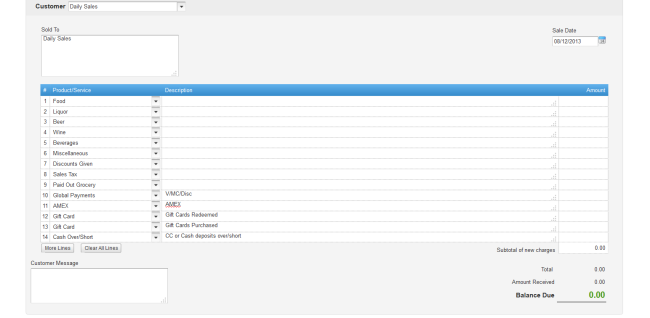

3. How are you claiming employees’ credit card and cash tips and how are they receiving those tips? More and more restaurants are switching to paying out credit card tips on employee paychecks. If this is your procedure, then make sure to still claim cash tips as a separate earning and matching deduction in order to tax the employee properly for all earnings.

4. Are you paying “time and a half” for overtime or “half time” as your overtime premium? So many restaurants and bars here in Texas pay overtime at “time and a half” when actually your overtime premium should be “half time.” Let’s take an example of an employee who worked 42 hours in week 1 and 37.5 hours in week 2 of a bi-weekly payroll. Since the overtime law in Texas requires an “overtime premium” to be paid after 40 hours in a work week, most employers would pay this employee 77.5 hours at regular pay and 2 hours at “time and a half” pay. This is actually incorrect, although the employee still receives the correct amount of money. To pay this employee correctly, the employer should pay 79.5 hours at regular pay and then add 2 hours at “half time,” which is the overtime premium. Here are the examples:

Incorrect: 77.5 hours at the regular rate of $2.13 + 2 hours of “time and a half” at $5.75.

(77.5 x 2.13)=165.08 then add (2 x 5.75) = 11.50 -> 165.08 + 11.50 = 176.58

Correct: 79.5 hours at regular pay rate $2.13 + 2 hours of “half time” premium at $3.62*

(79.5 x 2.13) = 169.34 then add (2 x 3.62) = 7.24 -> 169.34 + 7.24 = 176.58

As you can see, the employee receives the same amount of compensation either way, but if the employer tracks overtime separately from regular time, financially, they would not see a clear picture of how exactly overtime affects their business. Presumably, the employer would have needed an employee to work those 2 hours that accrued overtime, but if they were worked by another employee that did not go into overtime, then the employer would have paid that regular rate for the same 2 hours worked. With the above example, the effect of overtime was actually $7.24, not $11.50.

Payroll can be a pretty tricky task, so just make sure whoever is processing your payroll is either a Certified Payroll Professional, or has at least gone to numerous training and informational seminars within your state(s.) A little restaurant or bar payroll experience wouldn’t hurt either…….

*Some variance occurs due to individual rounding procedures.

JK Bookkeeping Solutions